|

|

The Most

Reliable |

|

|

Vendor Comparisons |

|

| WHY

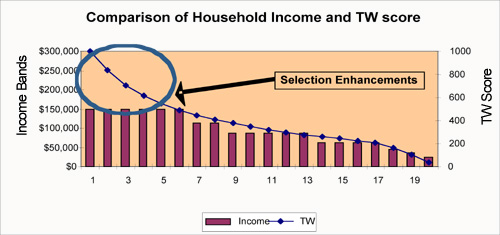

INCOME SELECTION IS INSUFFICIENT Using household income data as a foundation to which TruWealth can be compared, the insufficiency of income data is easily recognizable. With TruWealth, you can target the highest income earners-regular income data you cannot. |

|

|

|

|

|

|

METRICS

COMPARISON |

|

| TruWeath |

Others |

| Home l About

TruWealth l Why

TruWealth? l Vendor Comparisons

l Case

Study l Company

l Contact |

|